Managing to engage decision-makers at all levels of a company on sustainability matters is an all too common challenge for experts trying to improve environmental corporate performance. Sustainability professionals can use methods such as Life Cycle Assessment (LCA) to quantify the environmental impacts of their products or processes, or Material Flow Cost Accounting (MFCA) to quantify the true cost of the losses and in-efficiencies of their production system; however, this analysis is almost redundant if its results are not integrated into effective decision-making. How can environmental impacts be effectively communicated to corporate decision makers with a limited sustainability background? One potential solution is the monetisation of environmental impacts (i.e. converting impacts into monetary/financial terms). The new ISO 14008 standard will enable monetary valuation of environmental impacts and related environmental aspects.

Monetary Valuation of Environmental Impacts – Speak the Language of Your CEO

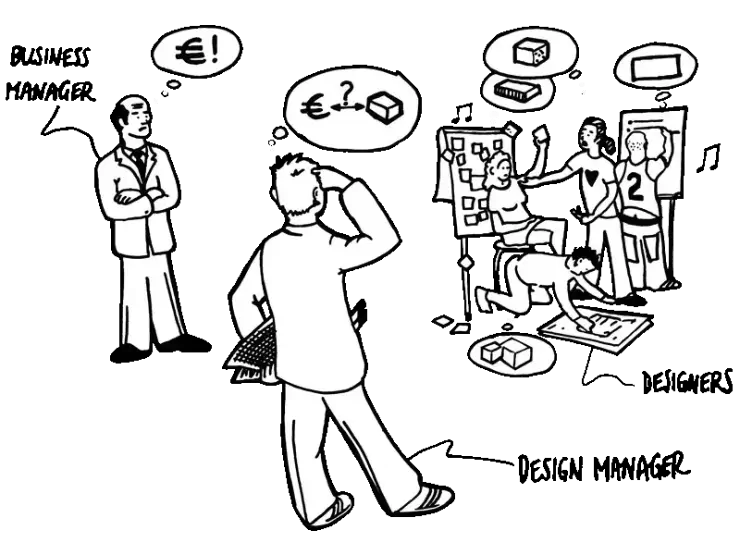

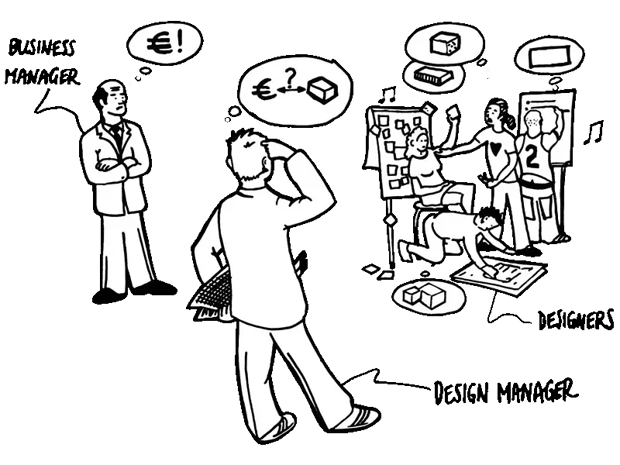

There are now hundreds of environmental pressures companies can consider when assessing the sustainability of their products or processes (such as greenhouse gas emissions or water consumption). These Key Performance Indicators (KPIs), result in units such as kgCO2e, µm PM10, tonnes of waste, or m3 water—language which is understandable to sustainability experts but is meaningless jargon to other decision makers (such as division managers, CFOs, CEOs) within a company. Monetization of these environmental indicators provides a much more intuitive understanding for these professionals, and is a key enabler for environmental pressures to be considered at all levels of a company hierarchy.

Monetization enables sustainability experts to communicate an understanding to colleagues in three key areas:

- the scale or magnitude of environmental impacts

- which environmental pressures and stressors are most important

- an estimate for future bottom line risks for the company.

Translate into monetary terms to enable decision-making

Translating a portfolio of environmental pressures into standardised monetary terms allows for a simplified understanding of the areas of greatest relative importance. This is imperative in pinpointing where to focus efforts for effective decision-making—even more so when a company has limited sustainability resources to work with. Monetization is also increasingly being used by companies as an internal benchmarking tool.

The Right Method: True Cost Accounting (TCA)

How do we go about this process of accounting for environmental impacts? There are a number of potential methods to do so, however most fall under a blanket-term of “True Cost Accounting” (TCA). Despite differences in the specifics of the methodology, all tend to follow a standard two-step process: assess environmental impacts in physical units (as well as social or health related), then apply a conversion process into monetary terms.

Using LCA to Measure the Impact of a Product or Process

The first step is to measure a product or process’s full operational and supply chain impacts in standard environmental KPI units. This can be evaluated using LCA the established method of assessing operational and supply chain impacts which is widely utilised by a range of companies. However, globalised supply chains are incredibly complex, and it’s often sometimes impossible to gather data from the entire supply chain (extending all the way back to raw materials).

Identify: Environmentally Extended Input Output (EEIO) modelling

How do we extend these datasets to consider the important of our suppliers’ suppliers? One option for extending the range of these assessments is to use an economic technique called Environmentally Extended Input Output (EEIO) modelling—a technique which identifies the deep interdependences of different branches of an economy. EEIO modelling helps to identify key impact “hotspots” across a supply chain, providing a crucial understanding of high impact suppliers which could be targeted for engagement. Important datasets from these high impact suppliers could be combined with LCA to give a more comprehensive assessment of supply chain impact.

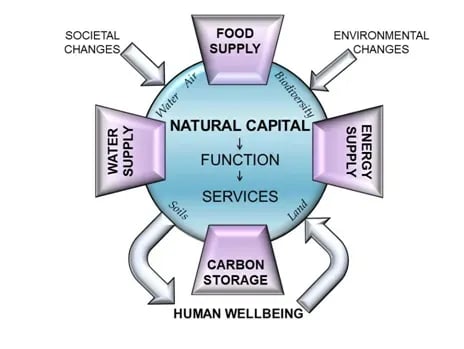

Converting: Total Economic Value (TEV) framework

The second step is to convert this physical footprint data into financial terms. This is typically done using valuation coefficients derived from a Total Economic Value (TEV) framework. TEV is defined as the sum of the values of all service flows that natural capital generates both now and in the future, appropriately discounted into current financial terms. This process is undoubtedly complex—developing economic values which fully encompass ecosystem services, scarcity and capital value is challenging. The process can also be incredibly subjective with key geographical and regional variability.

Calculate: the Regional Context Is Important

How much is a litre of water worth; how do we value an acre of land; what is the true cost of our carbon emissions? Monetization would be difficult at a local or national level but is even more complex in the operation of global markets. Take the example of water consumption: the value of the environmental impacts caused by water consumption highly depends of the regional context. The populations willingness to pay for reducing the water consumption depends if on the fact if water is scarce or not in a regional context.

One approach is to simply calculate an average value and apply it across our range of operations, regardless of regional context. A more accurate approach is to derive a location-specific value for each of the supplier’s geographies (which incorporates scarcity value) from published research. This choice of approach will be highly dependent on the complexity of a product’s supply chain, and the resolution of TEV data available.

The ‘True’ Cost of Production

Finally, multiplying TEVs (such as $/kgCO2e, or $/m3 water) by the total footprint of a product allows us to calculate the ‘true’ cost of its production. NAC at the product level can help to identify opportunities to reduce environmental costs by switching raw materials or product locations, optimising processes, and crucially targeting areas of its supply chain where the greatest costs are incurred. Communicating these issues to other stakeholders (whether internally, or externally) is made significantly easier when it can be discussed in monetary terms.

The New ISO/FDIS 14008 Standard

Despite significant progress in the development, as well as implementation of monetization methodology, the process can be complex and can incorporate a range of uncertainties. The need for better standardisation and guidance on how to monetize environmental impacts has led to the start of the development of a new international standard, ISO 14008: “Monetary valuation of environmental impacts from specific emissions and use of natural resources – Principles, requirements and guidelines”. This project is expected to be completed by March 2019. Contribution to this standard and process development is still very much open for input from relevant experts. If this includes you, you could make a valuable contribution to developing much-needed guidance on how we can make our performance indicators more transparent. Interested potential contributors may get in contact with their national standard body to get involved.