Many organisations are coming under increasing pressure to minimise the environmental impact of their activities, as well as optimising resource consumption to enhance the company’s cash flow. Material flow cost accounting (MFCA) is a tool, which can help an organisation do so by providing a means to trace waste, material, energy losses and emissions through its processes and activities.

Environmental costs are often left out

MFCA falls within the basket of tools used in environmental management accounting (EMA). EMA methods deliver a means of connecting a company’s environmental and economic performance, and provides a financial incentive for organisations to more consciously consider the sustainability aspect of their operations. These tools were developed in recognition that environmental costs were often left out of conventional management accounting techniques, leading to ill-informed or poor decision-making, with both environmental and economic consequences. EMA has provided a way to illustrate how improving environmental performance can also improve a company’s bottom line.

Material flow cost accounting (MFCA) – developed in Germany, popular in Japan

MFCA is one of the key tools within this set of accounting methods; it was developed in Germany in the late 1990’s but has become most prominent in its adoption in Japan in recent years. It is used to increase the transparency with which a company can trace the flows, transformations, stocks and losses of physical inputs (this can be any physical parameter including materials, energy and emissions) through its processes. As the common saying goes: “you can’t manage what you can’t measure”; MFCA provides a tool for measuring and better understanding resource usage, in the hope that steps can be taken to better manage waste streams and reduce material losses.

Quantify material losses in monetary units and identify the greatest savings

Reducing resource consumption provides obvious environmental benefits, but the crucial aspect of MFCA is that it quantifies the effect of these material losses in monetary units. This provides the necessary incentive for an organisation to take action, because ultimately it affects its bottom line. In a lot of cases, standard accounting and management systems fail to include or underestimate the level of associated costs for material losses. In MFCA, once the flow model of material usage has been developed, costs can be assigned to the losses which occur throughout the full value chain—this allows organisations to more effectively understand and target the areas in which they can make the greatest savings.

MFCA in practice

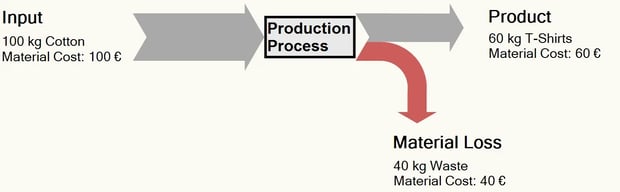

How does this accounting method work in practice? In its most simple form, MFCA works on the principles of mass/material balance. Let’s first imagine it applied in its most basic form, as a single process in a t-shirt production line. A certain amount of textile material is fed into our processing unit (technically termed a “quantity centre”), and we get a certain amount of product output in the form of t-shirts. If we measure that we put 100 kilograms (kg) of cotton into our processing unit, and we got 60kg of t-shirts out, we know that we’ve lost 40kg of material in the manufacturing process. This is what we call our “material loss”. In other words, in MFCA we try to balance our inputs and products, and when they don’t balance we know that material has been “lost” in the process.

In MFCA models, the flow of resources (this could be materials, energy, water, air, wastewater, for example) is measured in physical units such as mass or volume. The next step is then to assign monetary costs to each of these physical flows and losses. Four types of associated costs are quantified: material, energy, system and waste management costs. These are assigned to the products and material losses based on the proportion of the inputs that flow into each. In the example above, if the cotton input cost €100, we might conclude that we had an economic material loss of €40 (since 40% of our material was wasted). We would also have to add our energy and system costs to this (i.e. 40% of the cost of our processing unit’s energy and running costs), and additional waste management costs to handle our unused cotton.

Resource efficiency reduces operation costs

In doing this analysis, an organisation can not only see their resource losses (with its resultant environmental impact), but also be able to see where it’s losing out economically in its production processes. This gives companies the incentive to use resource efficiency (with the sustainability benefits that this entails) as a means to reduce its operation costs.

MFCA – scalable to your needs

When developing an MFCA flow, one of the key decisions to be made is defining the boundary which the model will cover. The tool can be scaled up or down to cover as much or as little as an organisation desires; it can be used to analyse a single isolated process; to model a whole factory production line; or even up-scaled to visualise a product’s full supply-chain. This scalability means an organisation can identify the largest inefficiencies across its activities and most effectively target the areas it can make the greatest savings.

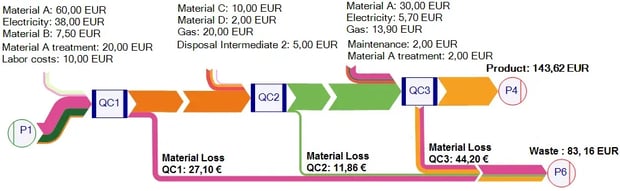

The figure depicts a sample case with three quantity centres (QC) including further cost types other than direct material costs. The accumulated costs associated to each QC sum up to the total waste costs.

Expand MFCA to the supply chain level

Product design generally involves an array of integrated processes and suppliers, each with their own inefficiencies and losses. These losses can often have unseen and unconsidered effects on the environmental and economic cost of a final product—no link in the supply chain is isolated from the processes occurring up and downstream. One of the latest developments in MFCA is therefore to explore its application across a product’s full supply chain (from this perspective, MFCA principles can be applied to enhance Life Cycle Assessment, LCA, tools). Expansion of the model’s boundary to the supply chain level not only gives an individual company a better understanding of its potential resource and financial losses, but also motivates a larger number of suppliers and firms to evaluate their own inefficiencies. In this way, MFCA can act as a driver for company collaboration to optimise full-chain resource efficiency.

Standardised methodology – ISO 14051

In order to standardise the MFCA methodology, the ISO Technical Committee developed a standard accounting protocol, ISO 14051 in 2011. This ISO protocol falls within the broader ISO 14000 family of standards for environmental management accounting. The ISO 14000 family also includes standards for the other most prominent sustainability measurement tools: the LCA standards, ISO 14040 and 14044.

More than 300 Japanese companies already use MFCA

Despite being developed in Germany, MFCA has gained largest traction throughout the Asia-Pacific region, but most prominently in Japan. The Japanese Government is currently trying to develop its application, increase understanding of its advantages and drive adoption of the tool throughout Japan. To date, more than 300 Japanese companies use the MFCA tool across a wide range of applications including manufacturing, logistics, construction and recycling (JMCA 2011). In nearly all cases, MFCA has proved to be an effective decision-making tool in making effective resource and cost savings for its adoptees.

LCA software Umberto includes MFCA tools

EMA software tools are in continuous development to both simplify the inputs required for organisations to use them, and enhance the applicability and usefulness of the model outputs. Our LCA Software Umberto provides methodology-specific products, including LCA, carbon footprinting and MFCA tools.

Make better, sustainable decisions

For individuals and organisations with an interest in sustainability and environmental management, the rewards from cutting material loss and waste seem intuitive. The power of the MFCA tool is that it can assist this group in making better resource management decisions, but also engage those who are less attuned to the benefits of sustainable practice. By coupling physical and monetary losses, MFCA software can show the latter how optimising resource efficiency is also effective in cutting their operational costs. In other words, building a more sustainable practice model simply makes good business sense.

References

JMCA, 2011. Material Flow Cost Accouting: MFCA Case Examples 2011,

.png)